nh bonus tax calculator

Ad Enter Your Tax Information. And while New Hampshire doesnt collect income taxes you can still save on federal taxes.

Bonus Calculator Bonus Pay Tax Calculator Tool From Viventium

The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022.

. Use the New Hampshire bonus tax calculator to determine how much tax will be withheld from your bonus payment using the aggregate method. If your state does not have a special supplemental rate you will be forwarded to the aggregate bonus calculator. Please note our calculator does not include the newly recommended 3 rise for 202223 recommended by the government as this has not yet been formally approved.

Another option is to put more of your paycheck into an HSA or FSA if your employer offers it. You will report the bonus as wages on line 1 of Tax Form 1040. Use this calculator to help determine your net take-home pay from a company bonus.

Nh bonus tax calculator Monday February 28 2022 Edit. For instance an increase of 100 in your salary will be taxed 3601 hence your net pay will only increase by 6399. You have nonresident alien status.

This information may help you analyze your financial. If your state doesnt have a special supplemental rate see our aggregate bonus calculator. For Taxable periods ending on or after December 31 2016 the BPT rate is reduced to 82.

STATE OF NEW HAMPSHIRE DEPARTMENT OF HEALTH AND HUMAN SERVICES. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. Ad File Your State And Federal Taxes With TurboTax.

Shows take-home pay after tax and pension. See If You Qualify To File State And Federal For Free With TurboTax Free Edition. Under FICA you also need to withhold 145 of each employees taxable.

Supports hourly salary income and multiple pay frequencies. Or use the expertise of a tax pro to help you do so Signing Bonus Tax. In the case of a non-combat zone military bonus pay or others subject.

Our online Annual tax calculator will automatically. A bonus from your employer is always a good thing however you may want to estimate what you will actually take-home after federal withholding taxes social security taxes and other deductions are taken out. The state tax year is also 12 months but it differs from state to state.

Once confirmed we will update our figures. The 2022 state personal income tax brackets are. Receive Blog updates via email.

See Why Were Americas 1 Tax Preparer. Your tax situation is complex. With this tax method the IRS taxes your bonus at a flat-rate of 25 percent whether you receive 5000 500 or 50 however if your bonus is more than 1 million the tax rate is 396 percent.

For 2022 New Hampshire unemployment insurance rates range from 01 to 85 with a taxable wage base of up to 14000 per employee per year. Tax Collector Operational Hours 7am to 5pm. See What Credits and Deductions Apply to You.

Calculates Federal FICA Medicare and withholding taxes for all 50 states. The state has the right to adjust its rates quarterly so look out for notices to make sure you pay the right taxes each quarter. Federal Bonus Tax Percent Calculator.

The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here. For 2022 New Hampshire unemployment insurance rates range from 01 to 85 with a taxable wage base of up to 14000 per employee per year. Past rules mentioned earlier in this article issued by the Internal Revenue Service required the Defense Accounting And Finance Service DFAS to withhold 25 of that bonus later reduced to 22 on payment.

Calculates Federal FICA Medicare and withholding taxes for all 50 states. How much will you be paid. Recently accepted a new job.

If your total bonuses are higher than 1 million the first 1 million gets taxed at 22 and every dollar over that gets taxed at 37. Before the official 2022 New Hampshire income tax rates are released provisional 2022 tax rates are based on New Hampshires 2021 income tax brackets. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year.

Similar to the tax year federal income tax rates are different from each state. Use Notice 1392 Supplemental Form W-4 Instructions for Nonresident Aliens. Estimate your tax withholding with the new Form W-4P.

NHS Pay Calculator for Nurses Healthcare Staff. This includes alternative minimum tax long-term capital gains or qualified dividends. The New Hampshires tax rate may change depending of the type of purchase.

A cash bonus is treated similarly to wages and is taxed as such. Wage. 50 of actual self-employment taxes paid 000.

Your employer must use the percentage method if the bonus is. For taxable periods ending on or after. New Hampshire Salary Tax Calculator for the Tax Year 202122 You are able to use our New Hampshire State Tax Calculator to calculate.

In many cases the IRS will use the percentage method because your employer will pay your bonus separate from your regular pay. The maximum an employee will pay in 2022 is 911400. New employers should use 27.

For taxable periods ending on or after December 31 2018 the BPT rate is reduced to 79. Discover Helpful Information And Resources On Taxes From AARP. Your average tax rate is 217 and your marginal tax rate is 360.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. On average homeowners in New. This is state-by state compliant for those states who allow the.

Signing bonus taxes would fall in the above category if received via cash gift. NHgov privacy policy accessibility policy. Some states follow the federal tax year some states start on July 01 and end on Jun 30.

Welcome to the State of New Hampshire Child Support Calculator. Military bonuses are subject to taxation at the time of payment. Organizations operating a unitary business must use combined reporting in filing their New Hampshire Business Tax return.

And remember to pay your state unemployment. This marginal tax rate means that your immediate additional income will be taxed at this rate. ICalculator aims to make calculating your Federal and State taxes and Medicare as simple as possible.

The New Hampshire real estate transfer tax is 075 per 100 of the full price of or consideration for the real estate purchases. One important difference with spending accounts and retirement accounts is that only 500 rolls over from year to year in an FSA. If you make 55000 a year living in the region of New York USA you will be taxed 12213.

This federal bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses. Deductions and personal exemptions are taken into account but some state-specific deductions and tax credit programs may not be accounted for. As the employer you must also match your employees contributions.

See Publication 505 Tax Withholding and Estimated Tax. This free easy to use payroll calculator will calculate your take home pay.

5 Must See Vintage Pinball Arcades Vintage Industrial Style

Tax Filing Tips For Hair Salons Barbers And Hairdressers Turbotax Tax Tips Videos

Which States Have The Lowest Property Taxes

Flat Bonus Pay Calculator Flat Tax Rates Onpay

States With No Income Tax Marcus By Goldman Sachs

Free New Hampshire Payroll Calculator 2022 Nh Tax Rates Onpay

Mapped The Cost Of Health Insurance In Each Us State

Sales Tax Definition What Is A Sales Tax Tax Edu

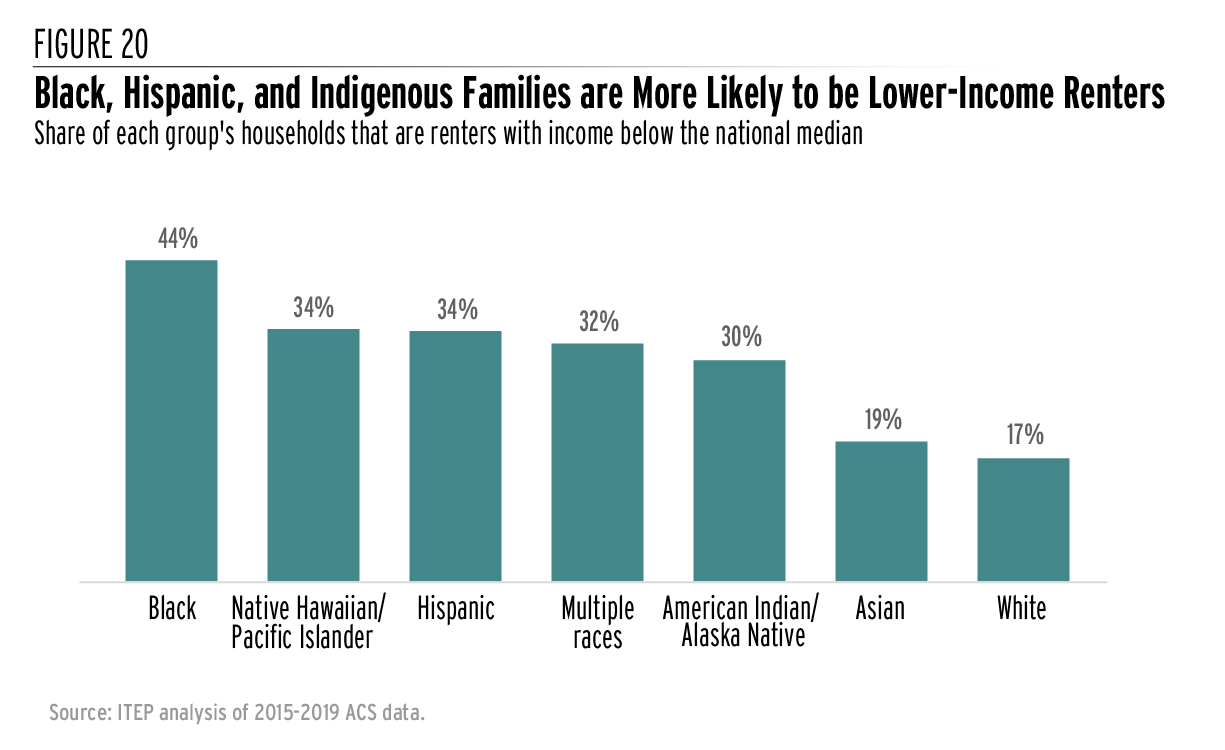

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

The Top 9 Benefits Of 529 Plans Savingforcollege Com

Deluxe Online Tax Filing E File Tax Prep H R Block

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

![]()

Flat Bonus Pay Calculator Flat Tax Rates Onpay

Bonus Calculator Bonus Pay Tax Calculator Tool From Viventium

Taxes On Vacation Payout Tax Rates How To Calculate More